Our Blog

Are You Being Too Picky?

Are you on a home buying journey? Does it feel like it is taking forever to find your perfect home? The problem may not lie with the homes you are looking at, but with your expectations. There are different lists …

Read More

Let’s Say it Again, You Don’t Need a 20% Down Payment!

We’ve been hearing throughout our lives that 20% down is the only way to buy a home. Not so fast! According to a recent survey done by Ipsos, the American public was found to still be a little confused about …

Read More

June is National Homeowners Month!

Happy National Homeowners Month! This June let’s take a look at why now is the perfect time to buy a home! Owning a home is an important part of the American Dream and an important milestone in one’s life. Core …

Read More

Resource Video: Homeowners Edition

Home-Maintenance Tips for New Homeowners Today’s video centers on establishing a home-maintenance routine program to ensure that you and your family live comfortably in your new home. This informational video provides key points on what to do to maintain your …

Read More

Moving? Four Tips for What NOT to Do!

Moving is stressful enough without everyone telling you how best to go through the process. There is planning, researching, packing and even more packing involved! With all of the chaos going on, it is important to keep sight of the …

Read More

How to Buy a Home While Paying off Student Loan Debt

Are you or someone you know excited about today’s robust housing market and wanting to buy but stopped by student loan debt? You are not alone. According to a 2015 survey by American Student Assistance, a Boston-based nonprofit, recorded that …

Read More

Resource Video: Millennial Homeowners

Rent vs. Buy – Millennial Homeowners Have you ever wondered whether or not you should be buying or renting? With student loan debt it may seem like renting is the easier option. However take a listen to our own Shorewest …

Read More

P.E.A.R., Not the Fruit but What Does it Stand For?

Americans are watching the real estate world slowly climb back up from our 2008 recession. Mortgage rates are at historical lows and people are realizing that not only can they afford a new house, they can upsize, downsize or even …

Read More

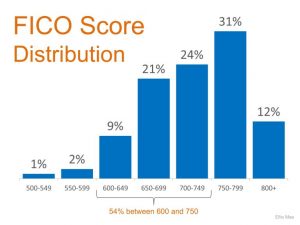

Get your Pre-Approval Now!

Lenders are packaging pre-approvals in many different ways today. Some are using rockets, colored buttons, fancy names and clever animation. I believe consumers are better off armed with more facts and less flash…after all, the real issue is, can you get …

Read More

Closing on Your Home? Here’s What NOT to Do!

The best part about closing on your new home is checking off the boxes. The loan is approved. The contract is signed. The title is clean. The closing date is set and all that is left is the actual closing …

Read More