There are two major misconceptions regarding qualifying for a mortgage; one is that you need a hefty down payment, and two is that your FICO score needs to be sky high. We want to address these concerns with the results from a study recently done by Ipsos, a global market research company.

Down Payment

The survey revealed that the American public overestimates the amount needed for a down payment. According to the report, 36% think that a 20% down payment is always required. According to the below graph, only 35% of Millennials who recently purchased a home paid 20% or more.

Below are the results of a Digital Risk survey done on Millennials who recently purchased a home.

FICO Scores

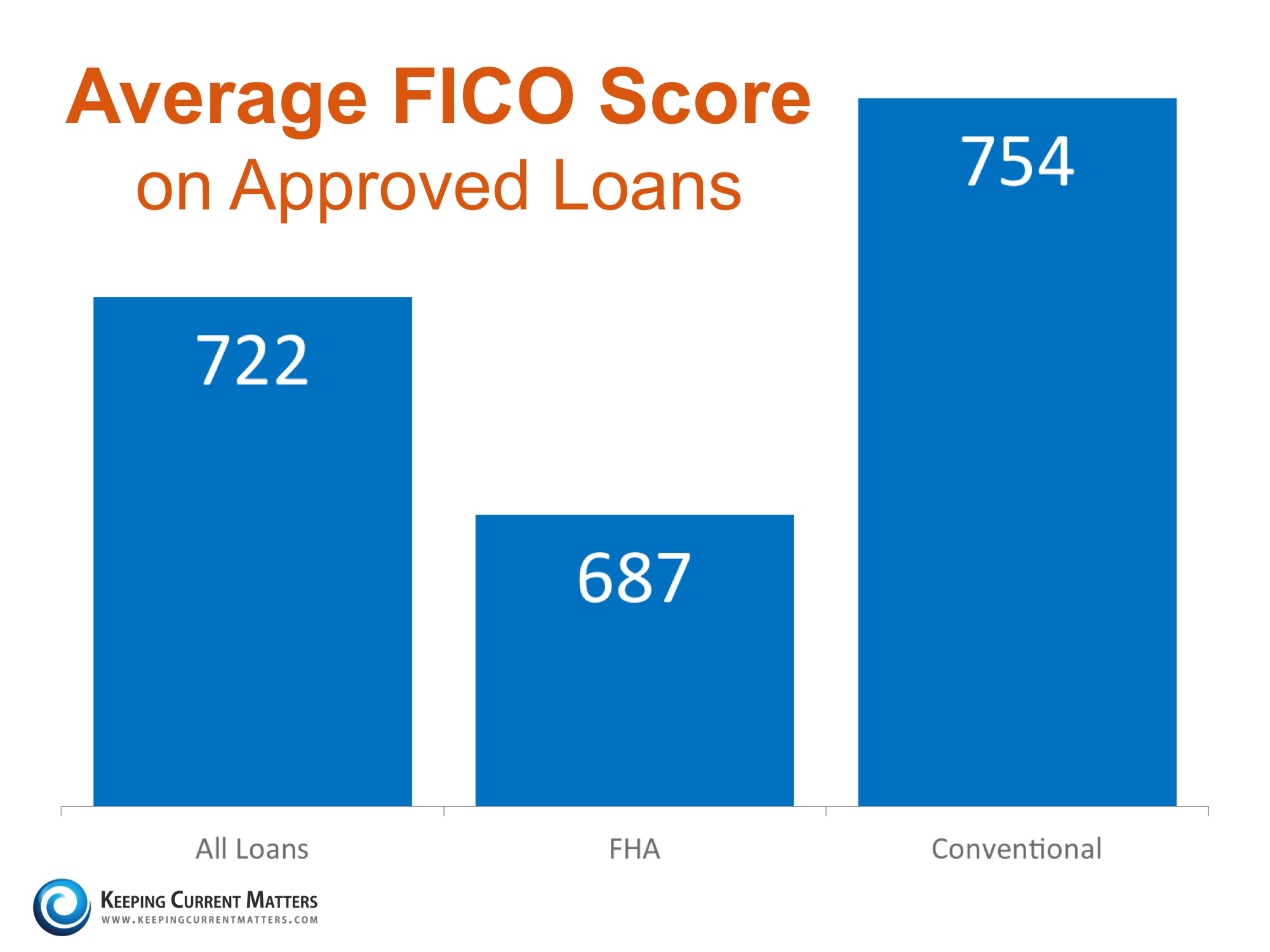

FICO stands for Fair Isaac Corporation, one of the largest and best known companies that provide software to calculate a person’s credit score. The Ipsos survey recorded that almost 67% of respondents believe that they need a very good credit score to buy a home. A “good credit score” was defined as being over 780! In reality the average FICO scores of approved conventional and FHA mortgages is around 721.

Below are the numbers from the latest Ellie Mae report.

When you see the numbers laid out like this, it is easy to see that a mortgage payment is not only accessible but fully affordable as well. Contact Wisconsin Mortgage Corporation today to sit down and talk about your true options. #Shorewest #ShorewestFamily #RealEstateTruths

Tags: millennial, millennial home buyer, Mortgage, real estate truths, shorewest, shorewest family, Wisconsin Mortgage Corporation

Categories: First Time Home Buyers, Home Buying, Mortgage, Real Estate News

Leave a Reply